Protecting Every

Family's Future - With

Endowment Plans

That Truly Work

EdGo is empowering the next generation of families to access flexible and fit-for-purpose endowment plans, designed to build generational wealth and protect their future.

Backed by AIICO Insurance Plc

Why choose EdGo

EdGo helps you access smart, flexible & affordable life insurance, including endowments, designed to build generational wealth and protect your children's future

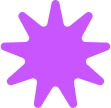

No paperwork. No jargon. No middlemen

Sign up in minutes—no agents, no forms, no confusion. Just simple, digital protection built for modern families.

Affordable, transparent, and mobile-first

Get clear, honest pricing and manage your coverage anytime, anywhere—from your phone.

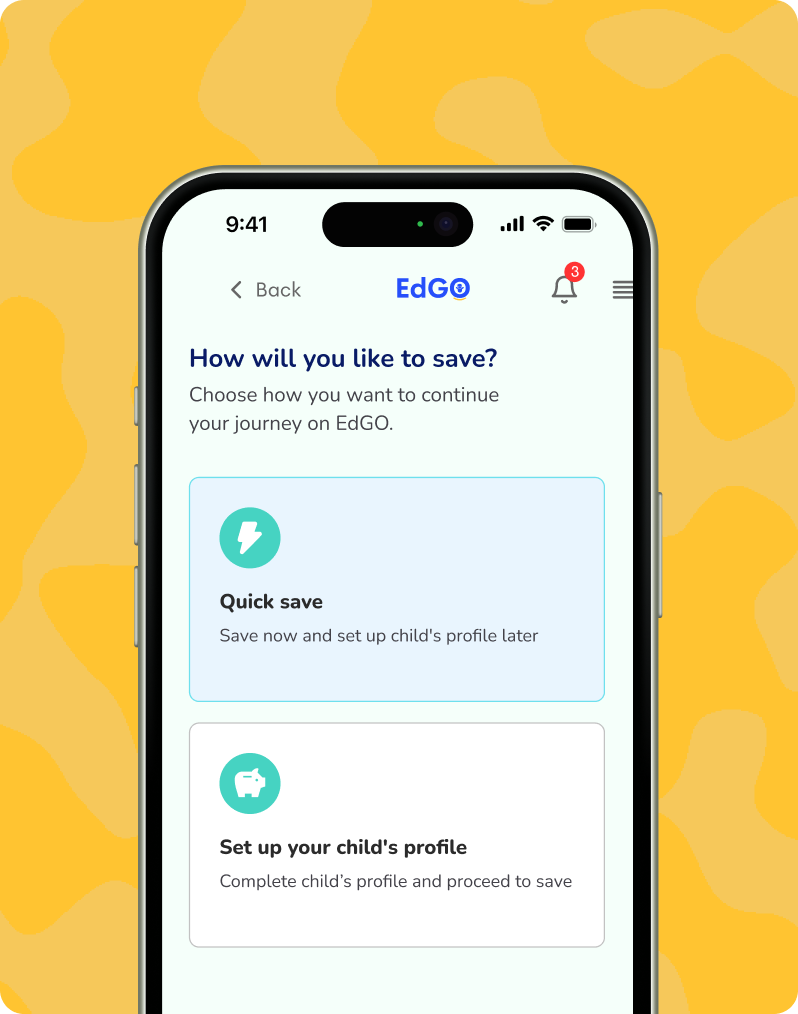

Personalized life policies for real family needs

Plans designed around your goals—from education to emergencies—so your family is always one step ahead.

Plans that grow with your life, not against it

Your coverage evolves as your needs change, ensuring you're always protected—today, tomorrow, and beyond.

How it works

From simple endowment plans to comprehensive life coverage, we make it easy to plan, save, and secure a better tomorrow.

Tell us about you

Help us understand your needs. Provide a few quick details to help us find the best plan that fits your lifestyle and protects the ones you love.

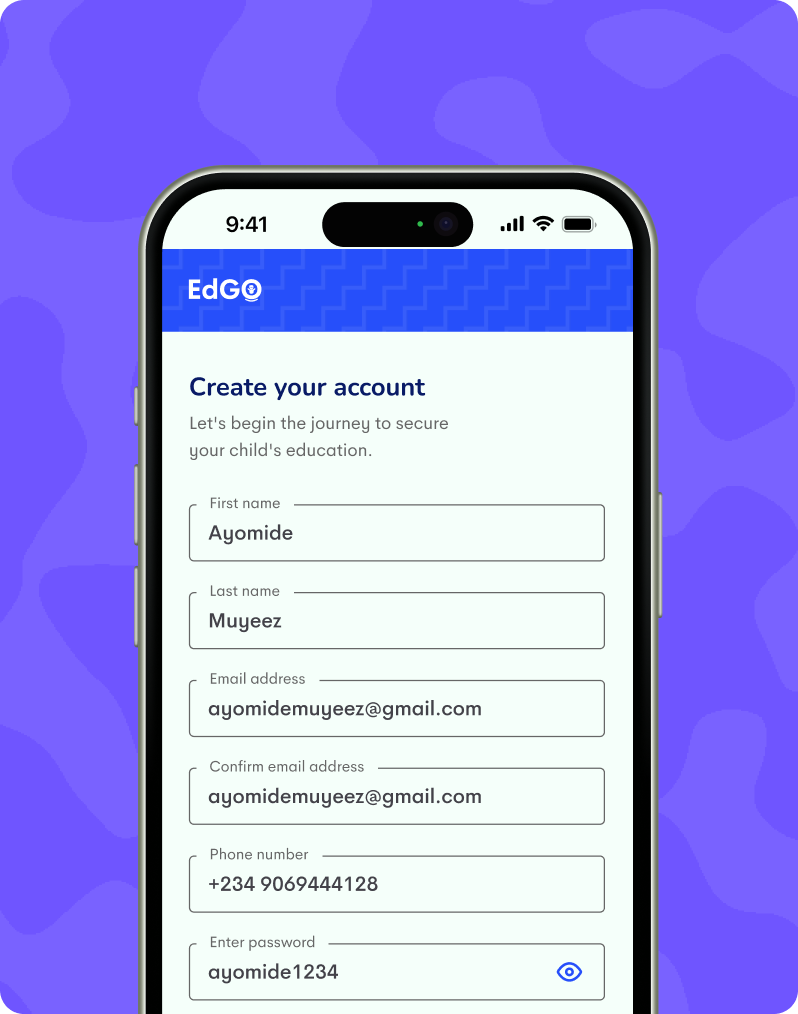

Get matched

Choose the life insurance plan that suits you best. We'll recommend the most suitable plans based on your personal and financial profile.

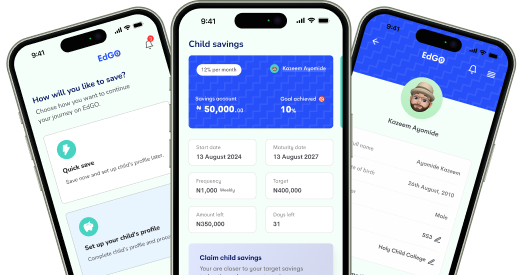

Activate your plan

Protect your future in minutes. Select your preferred plan and activate it with ease in minutes, on your mobile phone—no long forms or delays.

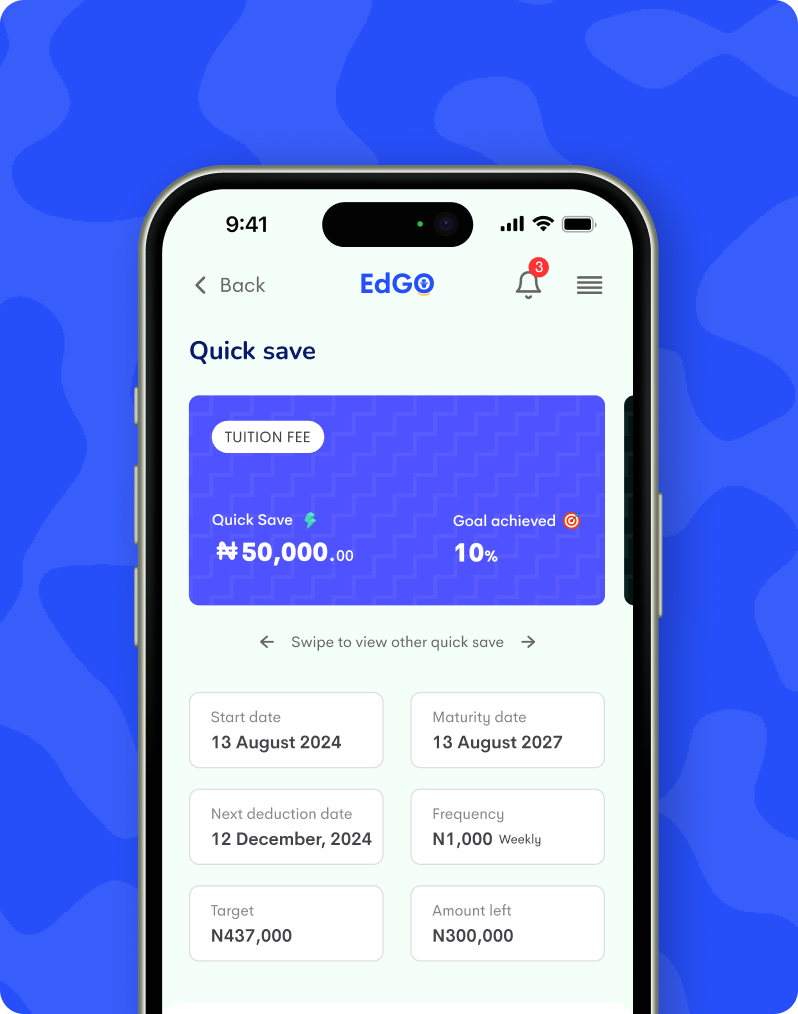

Track & update anytime

Manage your endowment plan on your terms. Monitor your coverage, make updates, and stay informed—anytime, anywhere, from your secure dashboard.

EdGo Affiliate

Introducing the EdGo Affiliate

Program - Earn While

Empowering Parents

We’re excited to introduce an opportunity for your institution or organization to empower your parents or employees and earn steady income with zero cost to you.

Download the EdGo App

Secure your child's education with EdGo

EdGo is backed by AIICO Insurance Plc.

Testimonials